OYO records first profitable year in FY24 with ₹100 crore net profit

Tata Steel's net profit fell by 64% in Q4 due to declining steel prices and restructuring costs, causing a 4% drop in share prices.

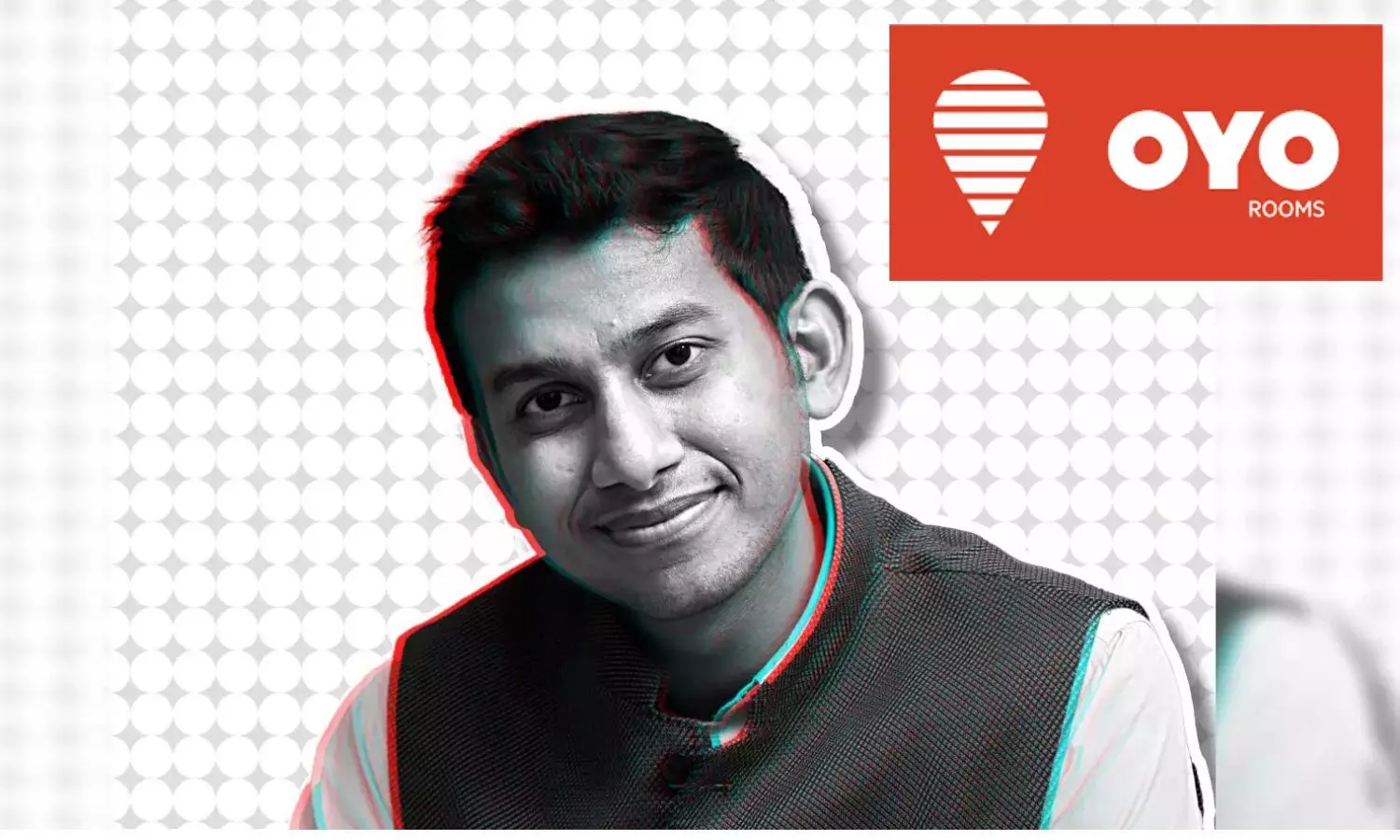

image for illustrative purpose

Tata Steel, a prominent player in the global steel industry, saw its shares fall by more than 4% after the company reported a significant decline in its net profit for the fourth quarter. The steel giant's net profit plummeted by 64%, a development that has raised concerns among investors and market analysts alike.

Tata Steel’s significant decline in fourth-quarter profit was largely attributed to falling steel prices and restructuring costs associated with its struggling UK operations. The company reported a 64% drop in consolidated net profit, reaching Rs 611 crore ($73.3 million) for the quarter ending March 31. The pressure on domestic steel prices was exacerbated by increased imports of finished steel from China, affecting the overall profitability.

The company's total revenue from operations fell to Rs 58,687 crore, down from Rs 62,962 crore in the same period last year. This decrease was partly due to a nearly 4% drop in its core Indian business, which accounts for about 62% of its total revenue. Additionally, Tata Steel incurred exceptional charges amounting to Rs 649 crore, primarily due to the closure of the Sukinda Chromite Block in Odisha and costs associated with its European operations. The company also announced plans to raise Rs 30 crore through the issuance of debt securities.

Tata Steel's significant drop in net profit for the fourth quarter has led to a notable decline in its share price, reflecting investor concerns over the company's financial performance. However, with strategic initiatives and a commitment to sustainability, Tata Steel aims to navigate the current challenges and achieve long-term growth and profitability.